KT SAT, part of the KT Corporation, is South Korea’s sole satellite services provider, with five satellites currently in orbit. The latest, KOREASAT-7 and KOREASAT-5A, were launched in May and October in 2017, respectively.

KT SAT’s main business was satellite transponder leasing in the domestic market until it started a global advance in 2015. The company’s customer list now includes 22 in seven countries, up from 13 in three countries, and its satellite coverage has expanded.

KT SAT has declared its goal to be the world’s seventh largest satellite operator by 2025, and to that end, has been expanding its global presence rapidly in the recent past – especially in Asia.

Dr Hahn Won-Sic, CEO of KT SAT, has had a long association with KT Corporation, having joined it in 1985. In a conversation with SpaceTech Asia, Dr Hahn talks about a wide range of topics from the possibilities of taking on projects in North Korea to quantum cryptography, blockchain, and 5G. He also lists out KT SAT’s three-point plan to become a global player in the satellite industry.

What are some of your current activities in Asia?

Until now, KT Sat was a local provider, but last year, after we launched two new satellites, we’ve acquired global coverage. We’ve gone from being a domestic player to a global player.

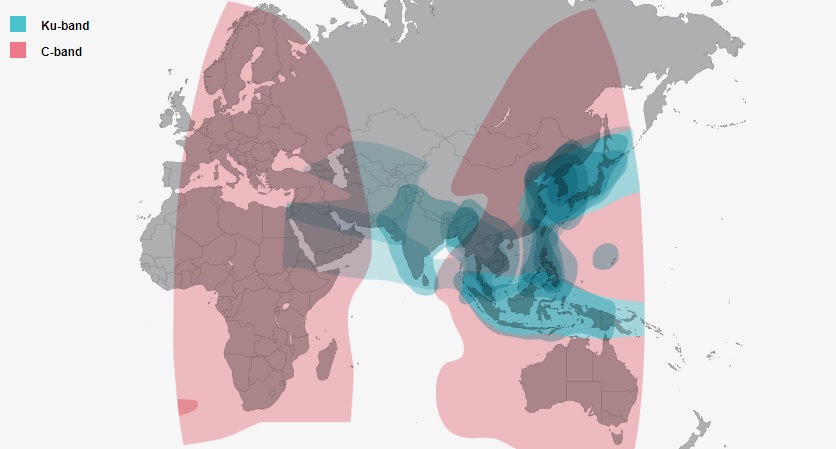

KOREASAT-5A extended KT SAT’s coverage from the Korean peninsula to the Philippines, Indochina, the Middle East and parts of South Asia. KOREASAT-7 covers the Philippines, Indonesia, Indochina and India. KOREASAT-5A has a beam covering Mongolia, and we also have a maritime beam that stretches over northeast Asia from from the Korean peninsula to the Middle East.

Therefore, not only have we expanded geographically, we have also expanded in terms of service for maritime applications, with a contract for providing services to five hundred thirty ships.

In the Philippines, we have a lifetime contract with a DTH customer, and in Mongolia we have a DTH customer (DDishTV). We are expanding our services to these new areas in broadcasting.

Following the April Summit, what are KT SAT’s plans in North Korea?

The environment is changing, and we hope it develops into a good relationship with the North. There’s a lot that we can do in terms of contribution and cooperation: in this regard, KT Corporation has created a task force and KT SAT will take part in this team. One of KT SAT’s key features is that we can quickly establish infrastructure for communications and broadcast.

Perhaps [we can] contribute to the broadcasting infrastructure for North Korea, but we are still investigating this. If we find out through our investigating process that they already have this infrastructure, maybe we would contribute a little less, so that would depend on the North Korean situation.

Could you talk about your growth strategy?

As you mentioned, we plan to be the seventh largest operator in the world by 2025, and we have a three-point plan to fulfill this this goal and objective.

The first thing is that we are trying to expand our global services. Previously we only had local presence, but we know that we’re going to have to grow global revenue.

We had – like all operators – leased transponders, but we would like to diversify our portfolio by adding some high value-added services. An example would be in-flight connectivity – it is hard to reveal in depth at this point, but we’re also thinking of inorganic growth (acquisitions, for instance) to sustain and develop our growth. This is the second part of our plan.

The third part is to participate more actively in government projects. There’ve been a lot of government projects related to the aerospace and satellite industries, and in the past we used to just maintain our role as an operator, but now we would like to be more actively involved in partnerships, which will also drive our domestic growth.

To wrap up the three aspects of the plan: the first is to strengthen our global revenue; second is to add value-added services to our portfolio; the third would be to participate more actively in government projects.

How will you use quantum cryptography and blockchain?

This is going back to the second part of the growth plan, which is about delivering new value-added services.

In most cases, the satellite industry talks about cost reduction in launching satellites or reducing CapEx, or HTS and providing optimisation for cost. That has been the main focus, and KT SAT would like to of course cost-optimise, but we would also like to bring new added services to the table.

Two of the key services would be quantum cryptography and blockchain. Internet security is one use case – this emphasis on security will enhance the satellite service and value, which will yield higher revenues.

Quantum cryptography is difficult to integrate into terrestrial fiber networks – we feel that’s not the ideal deployment mechanism. The satellite sector has a chance to commercialise quantum encryption. We feel that it’s the most complete sort of security service that we could provide.

In terms of applications, it could be used for military services, finance and banking, which would increase the value of satellite network services. If such customers’ needs are not being met through the terrestrial network, we could provide them through the satellite network. But of course, there are costs involved.

We see blockchain applications being commercialised much sooner than quantum encryption, in perhaps a year. Our KT Corporation group is working on this as well. An application could be in enhancing services in commercial maritime transactions.

What other new technologies do you think will change the space and satellite industries?

Maybe not in 3G, but in 4G, there was a differentiation between mobile and satellite networks. When 5G commercialises, mobile and satellite networks will complement each other, especially in providing connectivity to remote places and islands. We can achieve a “normalisation” of 5G and satellite networks to provide seamless service to consumers.

What do you think of the trend towards small satellites?

For small satellite constellations, at this point, KT SAT is in observation mode. We know that there are some limitations to these constellation services and we would like to see how they could be overcome. Our stance is to just step back and see how things evolve, but when it comes to 5G networks, we are getting closer to the right time for investigating the link between small satellite constellations and 5G.

IoT, HTS, and all these newer satellite technologies that are surfacing are making us think about our next step. That is to say, our next satellite – do we implement these new technologies or do we wait for other new technologies to evolve and surface?

IoT is something that we look into very deeply – especially satellite-specific IoT such as connected cars and ships. We are not only looking into the networks, but also into terminals and devices that are connected to IoT services.

How do you think South Korea’s space industry will change in the next 10 years? What about the Asian space industry in general?

South Korea is making greater investments in space development projects; I believe we are getting to about the tenth [rank] in a global standard and in terms of investment. South Korea is trying to build new launchers and satellites. We already have some technology such as for earth observation up in space. Korean launchers are ready to be launched this year in October. Of course they’re not commercialised yet, but there have there have been active investments in research and development of launchers and manufacturing of satellites in South Korea.

In Asia, as you know, China and Japan already have their own satellites and launchers which are all commercialised. We think the satellite and space industry will have a big role to play in Korea and we think that our government is trying to keep us aligned with the global trends.

Any final thoughts or comments?

When we talk about satellite industry, the digital divide is an important issue to address. Cities and urban areas have mobile, IPTV, and fiber infrastructure and are able to reap their technological and cultural benefits. Satellite technology is a solution to provide equal opportunities to rural communities. Another thing is that we’re so used to connectivity on the ground, and when we take an airplane or a ship we feel a disconnect – satellite is a way to patch these gaps.

We should not just talk about this or just promote the idea of it — I think we need to truly cooperate and create new services in order to resolve these issues.

Informative newsletter. I liked it.